reverse sales tax calculator bc

Amount without sales tax GST rate GST amount. Northwest Territories Nunavut and Yukon have no territorial sales tax at all.

Updated Canada Sales Tax Calculator Pc Iphone Ipad App Mod Download 2022

Sales tax amount or rate.

. The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. Formula for calculating reverse GST and PST in BC. Why A Reverse Sales Tax Calculator is Useful.

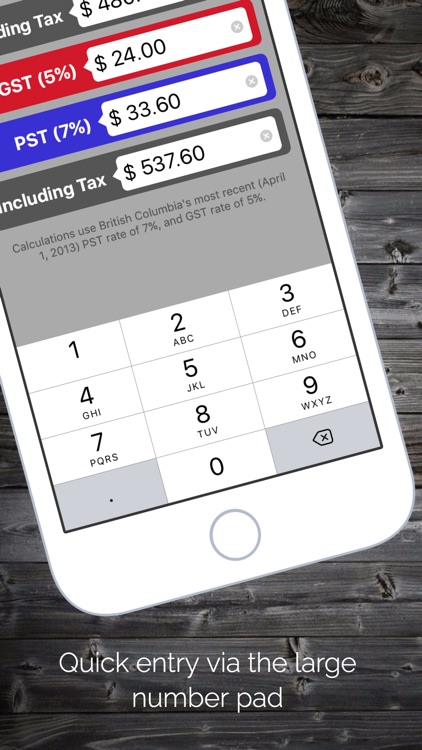

Do you like Calcul Conversion. Including the net tax income after tax and the percentage of tax. British Columbia is one of the provinces in Canada that charges separate 7 Provincial Sales Tax PST and 5 federal Goods and Services Tax GST.

Based on your inputs the reverse sales tax calculator will determine what your pre-tax price or amount is. Sales Taxes in British Columbia. The Provincial Sales Tax PST applies only to three provinces in Canada.

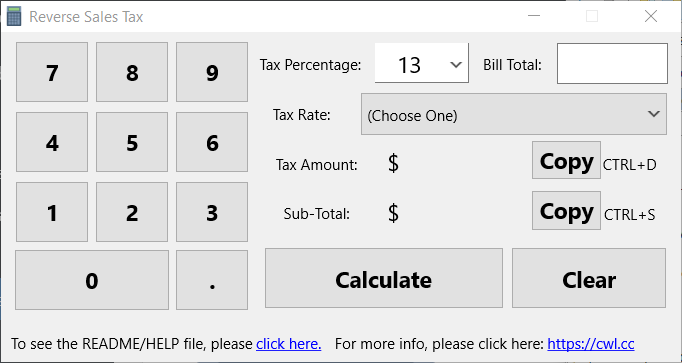

Hst reverse sales tax calculation or the harmonized reverse sales tax calculator of 2021 for the entire canada ontario british columbia nova scotia newfoundland and labrador and many more canadian provinces If you make 52000 a year living in the region of british columbia canada you will be taxed 10804. Reverse GSTPST Calculator After Tax Amount. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes.

Current Provincial Sales Tax PST rates are. Alberta British Columbia BC Manitoba Northwest Territory Nunavut Quebec Saskatchewan Yukon GST Tax Rate. This calculator include the non-refundable personal tax credit of Basic Personal Amount.

Following is the reverse sales tax formula on how to calculate reverse tax. Tax reverse calculation formula. Divide the price of the item post-tax by the decimal value.

Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax. Overview of sales tax in Canada. Margin of error for HST sales tax.

The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax. Amount with sales tax 1 GST and PST rate combined100 Amount without sales tax Amount with sales taxes x GST rate100 Amount of GST in BC.

Margin of error for HST sales tax. Enter The Final Price Or Amount. New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island.

Each province has their own set of tax brackets which. The reverse sales tax calculator exactly as you see it above is 100 free for you to use. Reverse Sales Tax Formula.

Due to rounding of the amount without sales tax it is possible that the method of reverse calculation charges does not give 001 to close the total of sales tax used in every businesses. Calculates the canada reverse sales taxes HST GST and PST. How to Calculate Reverse Sales Tax.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST Amount without Tax Amount with Taxes - Tax Amount. GSTPST Calculator Before Tax Amount.

Bc sales tax gst pst calculator. Most goods and services are charged both taxes with a number of exceptions. Understanding your calculate results.

Now you divide the items post-tax price by the decimal value youve just acquired. If you want a reverse GST PST calculator BC only just set the calculator above for British Columbia and it will back out the 12 combined tax rate for the amount you enter in. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund.

Other provinces in Canada do not use the HST and instead use a distinct Goods and Services Tax GST andor Provincial Sales. Amount without sales taxes x. Calculate the total income taxes of the British Columbia residents for 2021.

Enter either the sales tax amount in dollars such as 10 for 10 or the sales tax rate such as 85 for 850. Amount without sales tax x HST rate100 Amount of HST in Ontario. Amount without sales tax QST rate QST amount.

Choose which one you are using in the drop-down menu. Here is how the total is calculated before sales tax. The period reference is from january 1st 2021 to december 31 2021.

This simple PST calculator will help to calculate PST or reverse PST.

Canada Sales Tax Gst Hst Calculator Wowa Ca

Alberta Gst Calculator Gstcalculator Ca

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Sales Tax Canada Calculator App Price Drops

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Saskatchewan Gst Calculator Gstcalculator Ca

How To Calculate Sales Tax Backwards From Total

Pst Calculator Calculatorscanada Ca

Sales Tax Canada Calculator Free Download App For Iphone Steprimo Com

Bc Sales Tax Calculator Hst Gst Pst By Chewy Applications

How To Calculate Sales Tax Backwards From Total

Reverse Hst Calculator Hstcalculator Ca

Bc Sales Tax Calculator Hst Gst Pst By Chewy Applications

Sales Tax Canada Calculator On The App Store

Canadian Sales Tax Calculator By Fascinative

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Updated Canada Sales Tax Calculator Iphone Ipad App Download 2022